ELIGIBLE parents are expected to get seven child tax credit payments, totaling up to $3,600 per kid.

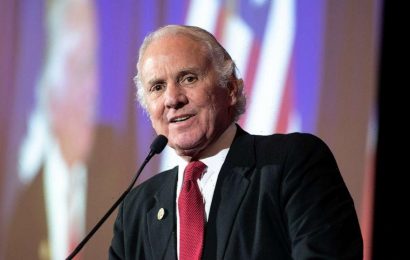

According to CNBC, the Internal Revenue Service (IRS) Commissioner Charles Rettig confirmed that the IRS is ready to send out the checks starting July.

Families who qualify for the CTC will get up to $500, $3,000 or $3,600 per child in a total of seven payments, reports CNET.

However, the new tax credit— which is meant to help parents pay down debts and bills— will be sent out through monthly payments from July to December.

Parents will need to meet certain eligibility criteria such as adjusted gross income restrictions.

If your household was already qualified for the $,1400 stimulus checks, you will receive half of the tax credit for now and will get the other half as refundable when you file your 2021 taxes.

Their dependents will also need to have specific eligibility requirements.

Each household is set to receive between $3,000 and $3,600 depending on each child’s age.

If you are part of a couple who is making $150,000 or if you are a single parent who is making under $75,000 a year, you are eligible to receive a $250 monthly payment for each of your children whose ages range between six years old and 17 years old.

For children under six years old, you are set to receive a $300 monthly payment.

Those earning over $75,000 or $150,000 will not receive full payments but will still qualify for some support under the expansion of the child tax credit, according to Yahoo Finance.

The IRS has been requested to set an online portal where families can update their family information, including the number of qualifying children in case of a newborn.

In case IRS hasn't received that update through the portal, you would need to claim the $3,000 or $3,600 credit for your new child when you file your 2021 taxes.

Meanwhile, there are some who might still be owed plus-up payments.

The IRS may owe you more money in case they have calculated your check based on your 2019 tax year where you may have earned more income than you did in 2020.

In this case, the IRS will send you a plus-up payment to make up for the missing amount.

The IRS is currently recalculating and sending “plus-up” payments as a credit on your taxes this year.

Eligible Americans can expect their plus-up payments to arrive every week if they have filed their 2020 tax return by now.

Source: Read Full Article